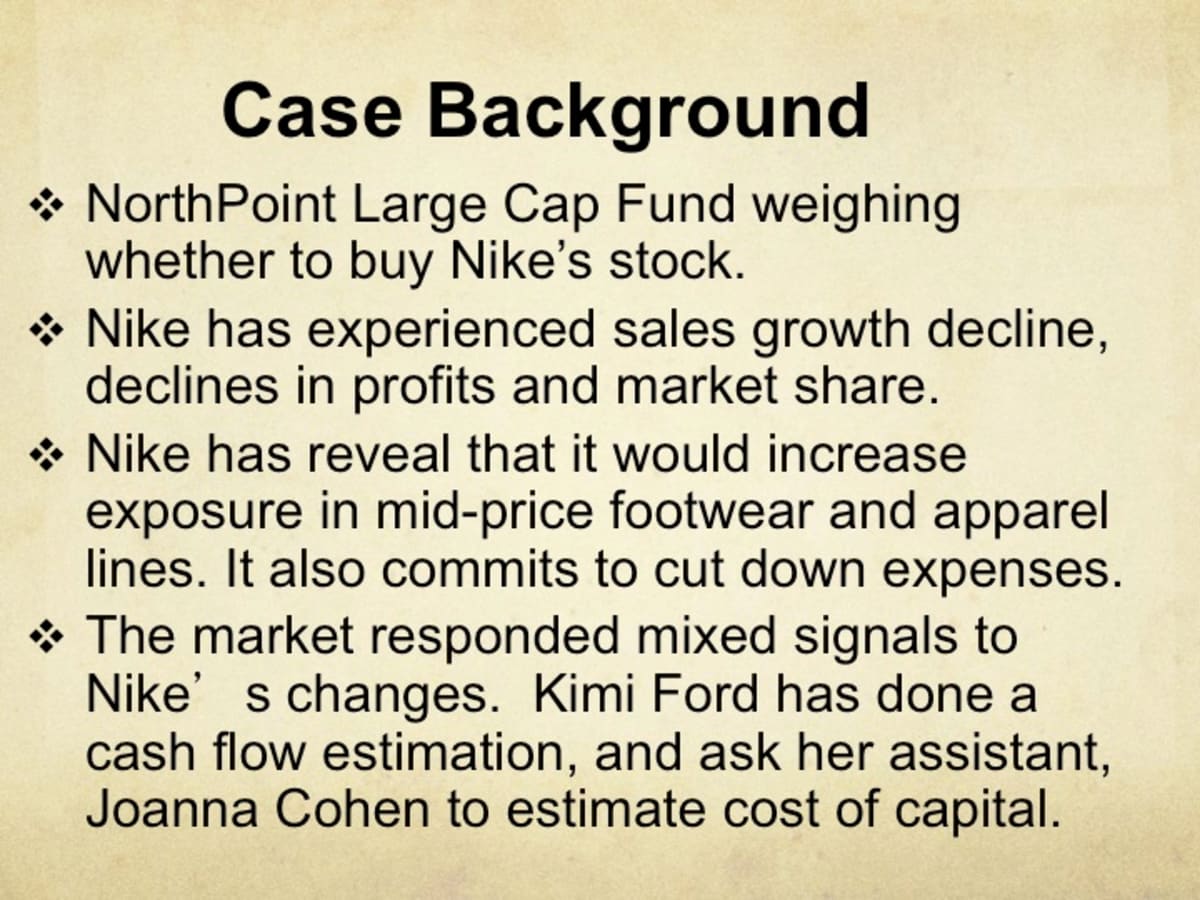

Nike Synopsis - NIKE, INC.: COST OF CAPITAL TO: Kimi Ford FROM: SAF SUBJECT: Nike's cost of capital - Studocu

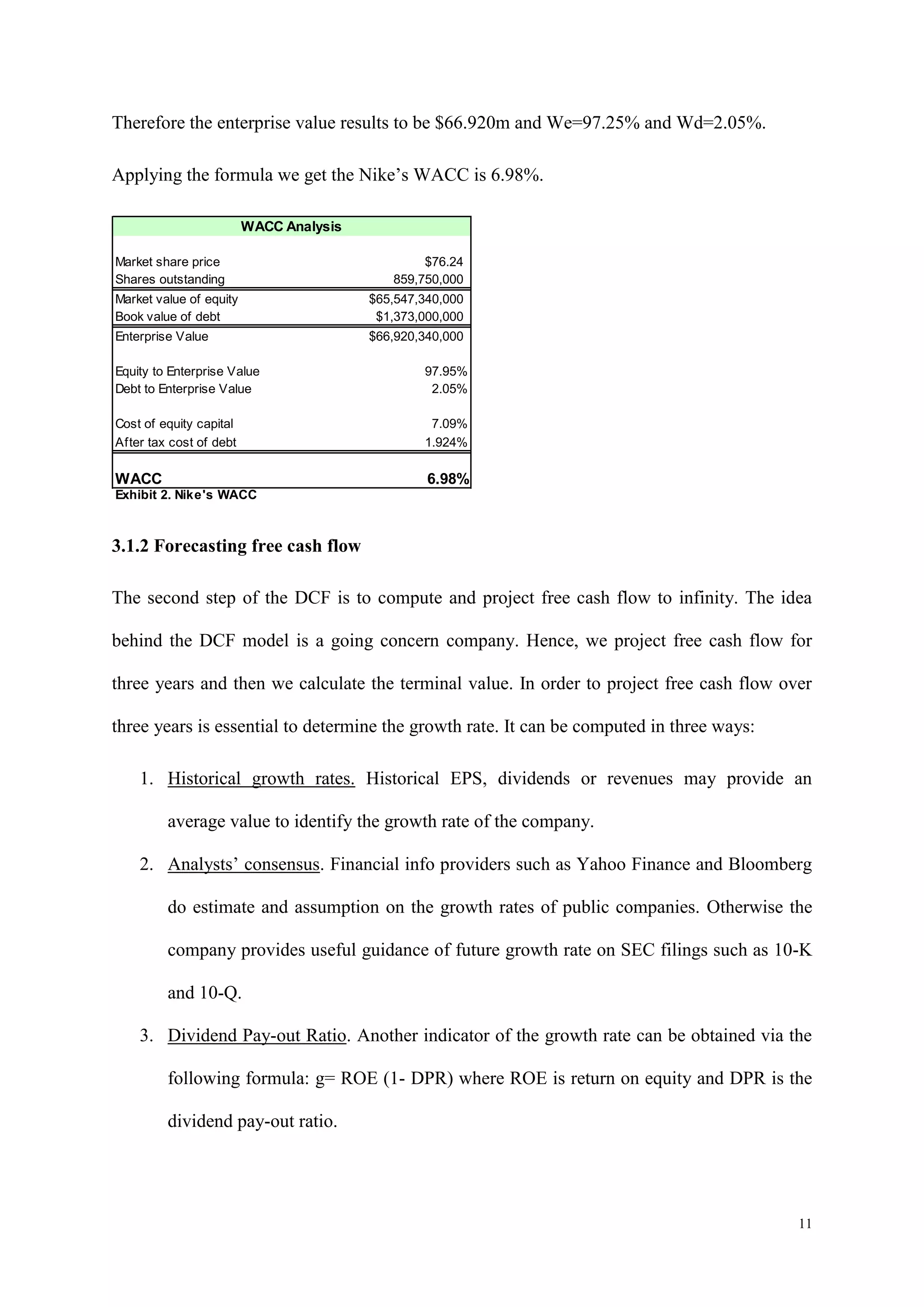

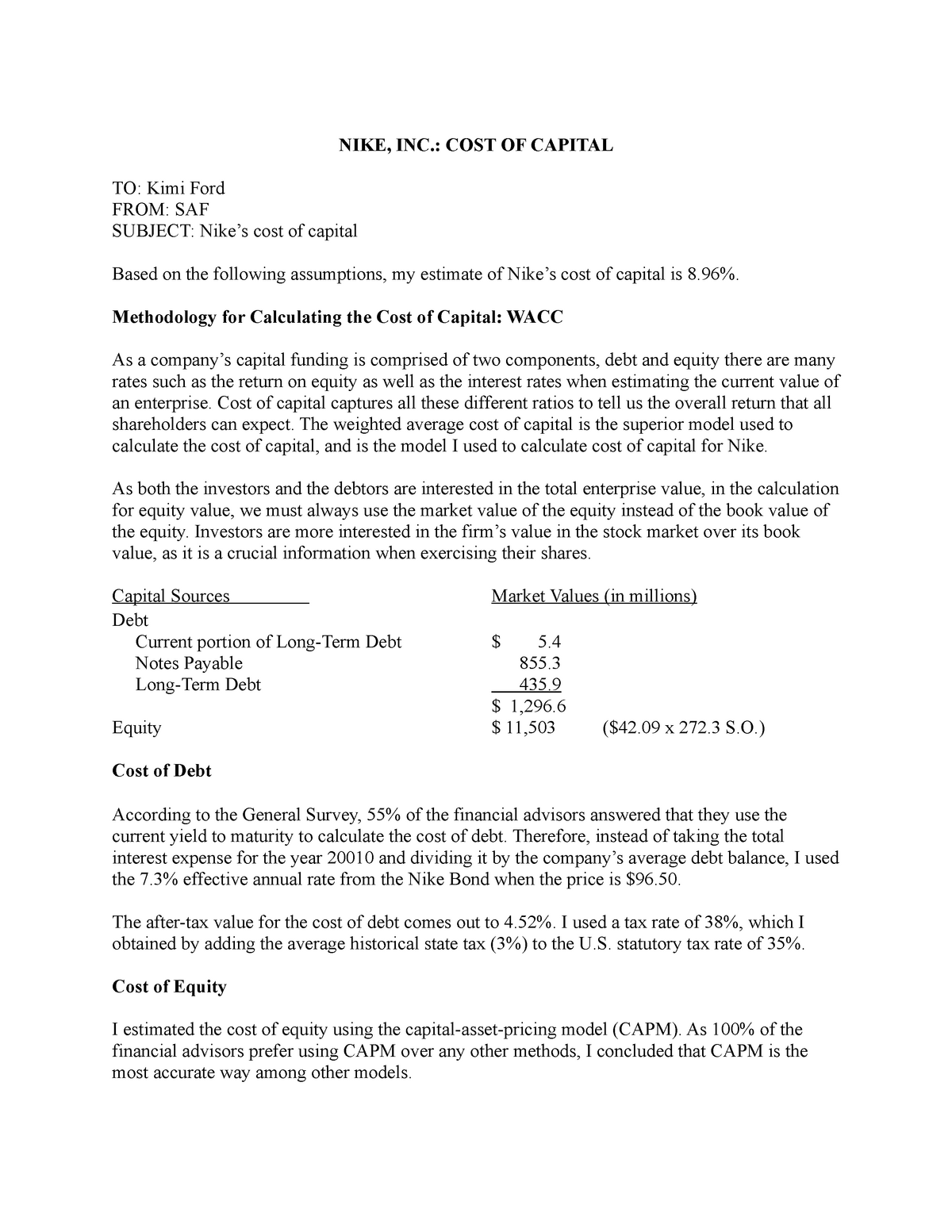

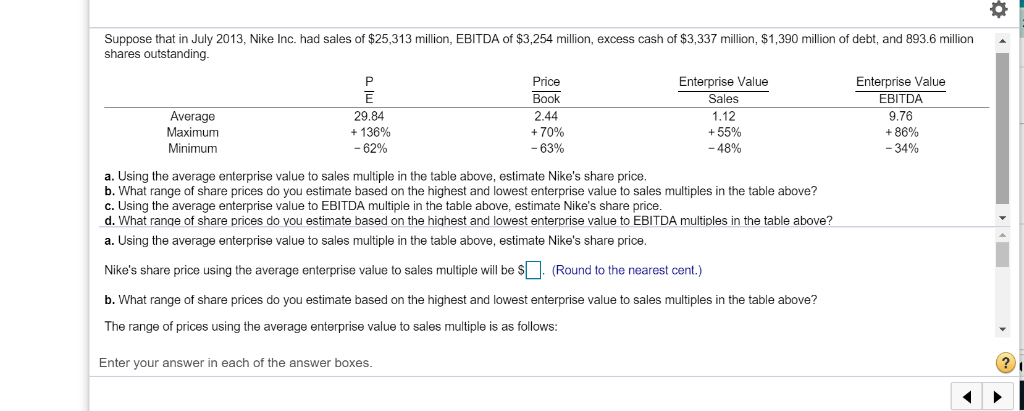

Problem 10-17 - Problem 10-17 Suppose that in July 2013 Nike had sales of $25 313 million EBITDA of $3 254 million excess cash of $3 337 | Course Hero

:max_bytes(150000):strip_icc()/GettyImages-1152522435-5e7fb93156e3488281174dbfd0bc70bc.jpg)